Learn

Ethical Investment Guide

31st May 2024

We know that many New Zealanders want to invest ethically but don't have the objective information and research to compare the options. This guide outlines the simple steps to transition your money to reflect your values.

You have the right to decide what your money is supporting.

We have created this guide so you can feel secure, empowered, and confident in whatever financial decisions you make.

We know that many New Zealanders want to invest ethically but don't have the objective information and research to compare the options. This guide outlines the simple steps to transition your money to reflect your values.

It's quick, easy and free.

Mindful Money's Ethical Investment Guide covers:

Why Invest Ethically?

Most Kiwis are aware of the ways that their purchases have an impact on climate change, the environment, or people.

Not buying factory-farmed eggs or cosmetics tested on animals. Choosing fair trade, less carbon-intensive or lower waste products. Walking more and driving less. These are all small changes in our lives that collectively put pressure on companies to change their behaviour.

Investing is no different. How we choose to invest our money makes a real impact.

It’s up to you to decide whether that’s a negative or positive impact.

Buying local produce, shopping without plastic, and purchasing ethically made clothing are excellent decisions, but investing your money in ethical funds can have a much bigger impact on people and the planet. Mindful Money enables exactly that.

You can earn good returns

It’s a myth that investing ethically means lower returns. In fact, research has shown that ethical investing earns returns that are as high or higher than conventional investing.

Why are the returns on ethical investment proving so high?

This is because companies with high sustainability standards are the most trusted companies. They have loyal customers and motivated employees. They have lower risks – they don’t get sued for environmental damage and they don’t operate in declining industries like coal or oil. As a result, their financial returns are high.

By contrast, there has been a string of companies that have behaved badly and suffered financially as a result - VW, BP, Enron, Solid Energy (Pike River mine).

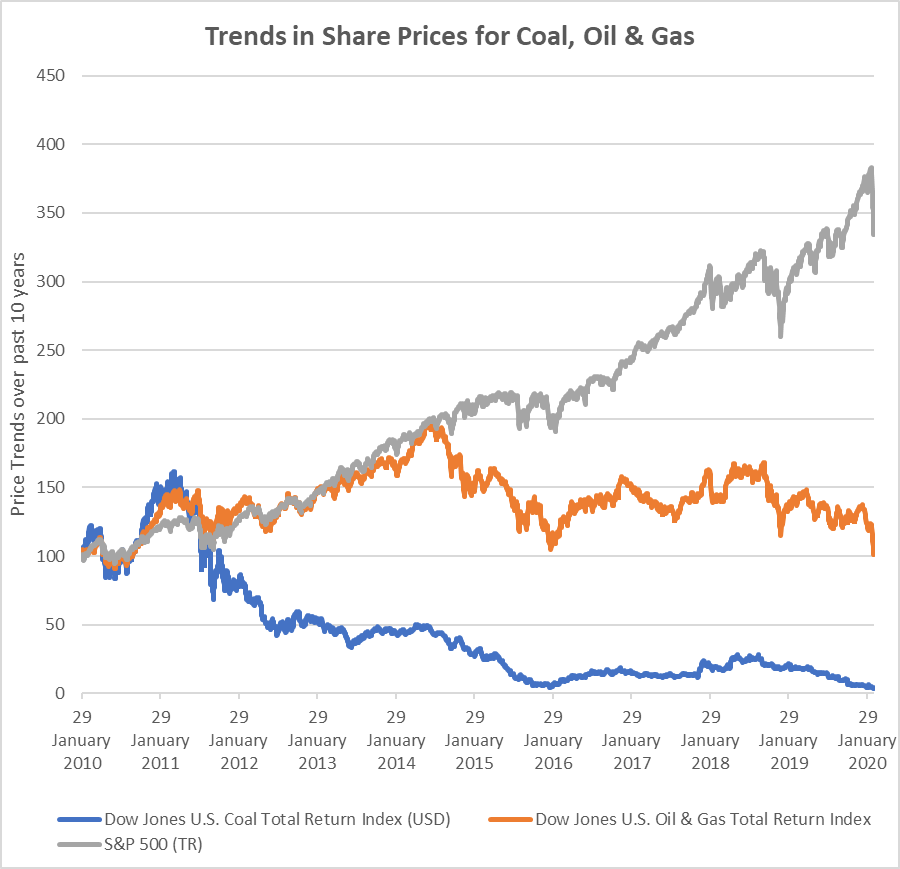

As an example, the chart above shows the value of investments in fossil fuel companies over the past ten years against the S&P 500. Since 2015, there have been ample warnings about the high risk of unusable oil, gas and coal reserves – our planet would fry if we used them all. These ‘stranded assets’ are likely to be worthless.

This chart shows the trend. Over the past 5 years, the average price of shares (S&P500 index - Grey) has almost doubled while the Oil & Gas Index has halved (Orange), and coal has collapsed (Blue). More than half the coal mines in the US have shut down and the biggest coal company went into bankruptcy. By contrast, cleantech and sustainability sectors are growing rapidly.

Where is Your Money Currently Invested?

Do you know where your money is currently being invested? It’s important to know which companies you are funding, and what those companies do.

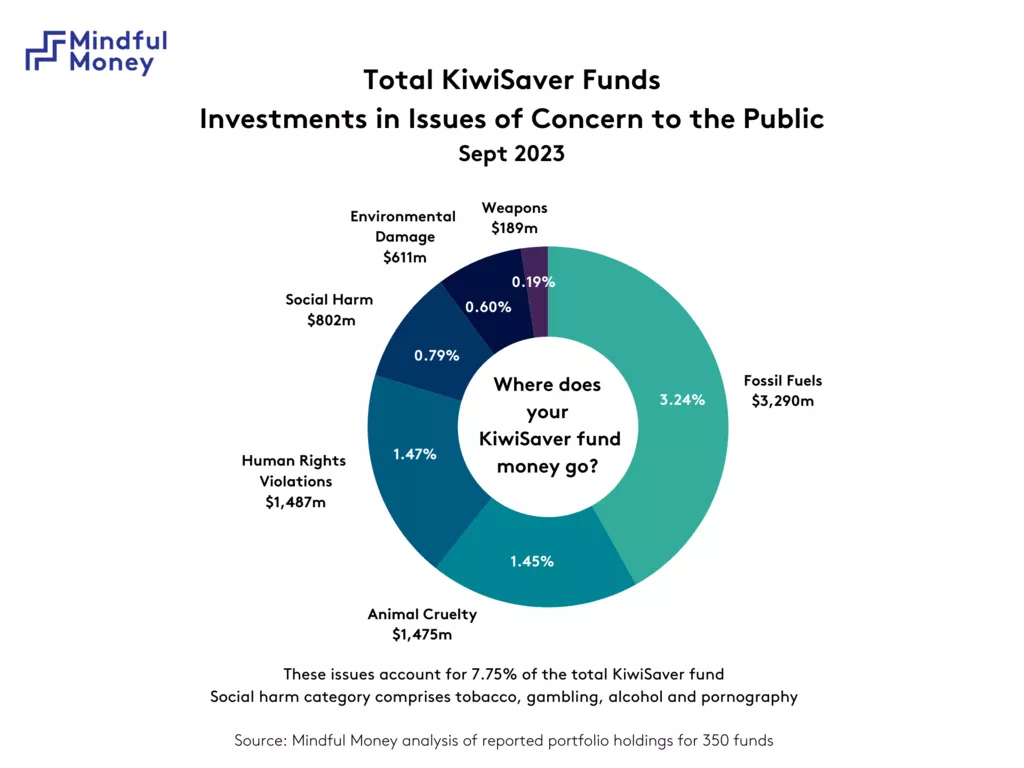

As of Sept 2023 our KiwiSaver funds are invested in the following:

Want to know if your money is supporting these industries?

We've created a fund checker that is free to use to find out what your money is currently being invested in.

All you'll need is:

- Which KiwiSaver fund or investment fund provider you are with

- What type of fund you are in (conservative, growth, etc).

Try it, you'll be surprised at what your money is getting up to when you're not looking!

This checker gives you the full picture – not just the companies your fund invests in indirectly, but also the indirect investments through the funds they invest in.

What subcategories we screen for:

Animal Cruelty

Animal Testing

Where companies are involved in testing products on animals for cosmetic, personal care, household product, chemical and other uses. We do not include companies which conduct animal testing for pharmaceutical products, medical devices, biotechnology, human food, or pet food.

Fur & Speciality Leather

Where companies are involved in the production or retail of fur & speciality leather products (where animals are raised purely for skins).

Factory Farming

Where companies are involved in intensive poultry operations, including managing direct operations which raise birds or managing a network of contracted farmers, slaughtering, packaging and onward sale to wholesalers, retailers, and restaurant chains.

Animal Welfare Issue

Where companies, through their products or operations, cause harm to animals e.g., animal entertainment (such as marine parks and rodeos), livestock exports, whale meat etc.

FIND FUNDS THAT AVOID INVESTING IN ANIMAL CRUELTY

Weapons

Nuclear Weapons

Where companies are involved in the manufacturing or sale of nuclear weapons or components or services thereof.

Controversial Weapons

Where companies are involved in the manufacturing or retail of controversial weapons (e.g., landmines and cluster munitions) or components or services thereof.

Firearms

Where companies are involved in the manufacturing or retail of firearms, including guns, rifles, pistols, or components or services thereof.

Military Weapons

Where companies derive revenue from the manufacturing of weapons or weapon components and services to the defence industry. We do not include non-weapons-related military support.

Fossil Fuels and Power Generation

Fossil Fuel Production

Where companies are involved in the production of fossil fuels (oil, natural gas, coal, shale oil) including exploration, production (including core services), storage, transport (except by rail) and refining.

Fossil Fuel Power Generation

Where companies source their power generation from fossil fuels (oil, natural gas, coal) to generate electricity.

Environmental Harm

Deforestation

Where companies are involved in, or directly linked to through their supply chain, the act of deforestation or clearance of forest that is then converted to a non-forest use.

Environmental Damage

Where companies, through their products or operations, are involved in environmental degradation e.g., pollution, chemical spills.

Palm Oil

Where companies are involved in the production or distribution of palm oil.

GMOs

Where companies are involved in the development or release of GMO plants and seeds.

Highly Hazardous Pesticides –

Where companies are involved in the production or distribution of highly hazardous pesticides, according to the PAN International List of Highly Hazardous Pesticides.

Human Rights Abuse Free

Labour Rights Violations

Where the actions of companies have violated global standards on labour rights and freedoms; including poor treatment of workers, child and forced labour, and modern slavery.

War & Conflict

Where a company is complicit in its products or services enabling violations of the Geneva Convention and infringement of the rights of individuals in war or conflict situations.

Business Ethics

Where low standards of ethics create harm because of poor culture and inappropriate incentives, inadequate governance and oversight, and incidents of bribery and corruption.

Public Safety Issues

Where companies are involved in significant harm to individuals or communities, through the unsafe nature of their products or delivery of services and inadequate response to evidence of harm.

Human Rights Abuses

Where the actions of companies have violated global standards on human rights and freedoms including customary rights of indigenous people.

Social Harm

Tobacco

Where companies are involved in the production or retail of tobacco, or tobacco-related products and services.

Gambling

Where companies are involved in the manufacture or retail of gambling specialised equipment, gambling supporting products and services, or gambling operations.

Adult Entertainment/Pornography

Where companies are involved in the production or distribution of adult entertainment.

Alcohol

Where companies are involved in the production or retail of alcoholic beverages, or alcohol-related products and services.

Your investments are matched with the issues that most Kiwis are concerned about, as measured through our annual surveys.

You can then decide whether that’s OK, or if you can use the Fund Finder to find a more ethical option.

I thought I was already invested in an ethical KiwiSaver. However, Mindful Money showed me that there is a difference between what I call "responsible" investing and what the big banks do. Plus it made taking action on this information really easy.

— Tania Hack

Even though most Kiwis want their fund providers to avoid unethical investments,

Choosing a fund that aligns with your values will ensure that your money isn’t being used to fund harmful impacts, but instead, more of your money is used to support good companies and positive impacts.

What are the Different Ways to Invest Ethically?

Let’s help you to understand the different ways you can invest ethically.

- Traditional Funds

-

These are most investment funds. Their purpose is to manage risk and earn returns, and

they

ignore the impact the companies have on the environment and society.

- Ethical or Responsible Investing

-

There are four main approaches:

Avoid harm

These funds screen out the sectors which cause social or environmental harm, for example, tobacco, fossil fuels, etc...

Engage

Most funds now use Environmental, Social, and Governance (ESG) factors to evaluate companies and reduce their risks. These funds usually exclude the worst companies and engage with others as an active shareholder to improve their ESG performance

Better companies

Some funds target investments into businesses with higher ESG or sustainability standards like All Good Organics or Kathmandu

- Impact Investing

- Investing to directly create a measurable, positive impact, while still making a financial return. Examples of ‘impact investing’ are investments in renewable energy, social housing, or healthcare. A related but broader concept is tikanga-led investing, which has embodied this approach within a te Ao Māori worldview.

Impact Investment in New Zealand

The concept of creating positive impact as well as financial returns is appealing. But we need your help to make it happen.

Currently, there are some New Zealand impact investment funds available to professional investors, but there are no credible KiwiSaver or investment funds available to members of the public. We want to demonstrate that there is public demand for impact investing and persuade fund providers to give the public opportunities to invest in positive social and/or environmental impact.

Change will be driven by consumer demand. If enough people say that they want impact investing, we can make it happen.

We have created a directory of impact investment available in New Zealand.

The Retail Impact Directory, perfect for everyday Kiwi consumers looking for impact financial products, and the Wholesalers Impact Directory, aimed at wholesale investors seeking impact investment options.

Join Mindful Money’s campaign for impact investmentHow do I switch to Ethical Investing?

It’s easy, free, and quick to switch

We hear from so many people that they would like to switch but they are put off by thinking it is really difficult to do. That’s why we set up the Mindful Money website: we have done the research so you don’t have to.

I would like everyone to check what their Kiwisaver is invested in because it’s much easier to find out than you think.

Choose a fund that suits you

Use Mindful Money’s Fund Finder tool to find the funds that meet your criteria. We take you through three easy questions:

- What values are most important to you?

- What investment approach do you want to use?

- What is your risk profile?

Being prudent means taking the time to find out about what’s available and only investing when you have considered your options. Finding out your risk profile is one of the crucial steps in your investment decision.

Each person has their own priorities and that’s where I think the Mindful Money website’s pretty cool.

Investments are often put into different categories, depending on the level of risk:

- Defensive – a high proportion of relatively safe investments (such as cash or short term deposits)

- Conservative – a high proportion of debt (generally bonds) and less shares

- Balanced – a balance of debt and shares

- Growth – mainly company shares, generally listed on seigk exchanges

- Aggressive – some high growth, high-risk shares including small unlisted companies or property

If you are young and saving for the long term, you may choose to accept higher risks (on the basis that the highs and lows even out over time). Those who are approaching retirement generally prefer less risk, to ensure their savings are protected.

There is a very handy guide to finding out your risk profile on the Sorted website.

Make the switch

Once you’ve selected your criteria, the Mindful Money website shows you four options that most closely match your criteria. You can find out more using the Fund Details button, and when you’re ready, choose to switch your KiwiSaver fund or make an investment. The Referral page will link you directly to the fund provider’s application form.

Find a fund that fits your values.

Find a Fund

The Referral page will link you directly with the fund provider’s application form. You need

to have

your driver’s license or passport handy in order to complete the form. Then that’s it. You don’t

need to contact your bank or even remember the name of your current fund. The fund provider will

do

the rest.

Help build the Mindful Money Movement

As a new charity, Mindful Money is trying to get the message out. We don’t have big budgets for advertising, so it’s up to you! Some ways you can contribute to our movement are:

- Please share far and wide on your social networks and pass this guide onto others

- Invite us to talk at workplaces or an event - email info@mindfulmoney.nz

- Become a Mindful Money ambassador!

- Donate to our charity

.