Invest for Climate Action

Is your money supporting the climate crisis?

How to find a climate friendly KiwiSaver, free from investments in fossil fuel companies.

Is your money supporting the climate crisis?

If you have a KiwiSaver fund, chances are that it is.

Mindful Money's calculations show that over $4.4 billion of KiwiSaver money and $4.8 billion of other NZ retail investment funds is invested in companies that are involved in fossil fuel extraction, production and use for electricity generation (analysis of September 2024 data).

This is not only bad for the climate, it’s bad for your returns.

Angry? So are we.

But together we can make our KiwiSaver funds a force for good.

Join thousands of other New Zealanders who have checked their KiwiSaver funds and found a new fund that fits their values.

It takes less than 15 minutes to move to a fund that fits your values.

Climate Friendly KiwiSaver and Investment Funds

The list below are funds that are free from fossil fuel producing and generating companies, or those that invest only in companies on a credible net zero pathway (such as Contact Energy, which will be over 95% renewable energy sources within the next few years).

Note: The list includes only funds with fossil fuel companies in their investing universe (e.g. not property companies, crypto, NZX10, etc) and only aggressive, growth or balanced funds that have at least 35% in equities. There are other fossil fuel free funds beyond these requirements - use the Fund Checker to be sure.

KiwiSaver Funds that are Climate Friendly (based on September 2024 data)

- AE KiwiSaver Plan

- GoalsGetter Nikko AM Ark Disruptive Innovation Fund

- GoalsGetter Nikko AM Global Shares Fund

- GoalsGetter Pathfinder Ethical Growth Fundnd

- InvestNow Mint Australasian Equity Fund

- Investnow Pathfinder Ethical Growth Fund

- Kernel KiwiSaver NZ 50 ESG Tilted Fund

- Kernel KiwiSaver S&P Kensho Moonshots Innovation Fund

- Koura KiwiSaver New Zealand Equities Fund

- Koura KiwiSaver US Equities Fund

- NZ Funds Balanced Fund

- Pathfinder KiwiSaver Balanced Fund

- Pathfinder KiwiSaver Growth Fund

- QuayStreet Socially Responsible Investment Fund

- Sharesies Pathfinder Ethical Growth Fund

Investment Funds that are Climate Friendly (based on September 2024 data)

- AE Investor

- BetaShares Australian Sustainability Leaders Fund

- BetaShares Global Sustainability Leaders Fund

- BetaShares Global Sustainability Leaders Fund (NZD Hedged)

- Castle Point Ranger Fund

- Devon Sustainability Fund

- Elevation Capital Global Shares Fund

- Epoch Global Quality Select Equity Fund

- Fisher Funds Australian Growth Fund

- Fisher Funds International Growth Fund

- Fisher Funds Lifesaver Trans Tasman Equity Fund

- Fisher Funds New Zealand Growth Fund

- Fisher Funds Premium Australian Fund

- Fisher Funds Premium International Fund

- Fisher Funds Premium New Zealand Fund

- Fisher Funds Trans Tasman Equity Trust

- ForsythBarr Global Growth Fund

- Generate Australasian Managed Fund

- Harbour Sustainable NZ Shares Fund

- Hyperion Australian Growth Companies Fund

- Hyperion Global Growth Companies Pie Fund

- Kernel NZ 50 ESG Tilted Fund

- Kernel S&P Kensho Moonshots Innovation Fund

- Lighthouse Global Equity Fund

- Mercer Ethical Leaders NZ Shares Fund

- Mint Australasian Equity Fund

- Mint New Zealand SRI Equity Fund

- Nikko AM Ark Disruptive Innovation Fund

- Nikko AM Concentrated Equity Fund

- Nikko AM Global Shares Fund

- Nikko AM Global Shares Hedged Fund

- NZ Funds New Zealand Utilities

- OneAnswer SAC Equity Selection Fund

- Pathfinder Ethical Growth Fund

- Pathfinder Ethical Trans-Tasman Fund

- Pathfinder Global Responsibility Fund

- Pie Australasian Growth Fund

- Pie Growth UK & Europe Fund

- QuayStreet Smartshares CIP NZ Core Equity Fund

- QuayStreet Socially Responsible Investment Fund

- Salt Sustainable Global Shares Fund

- Simplicity NZ Share Fund

- TAHITO Te Tai O Rehua Fund

- Tempo Future Cities Fund

- Tempo Tech Fund

- Tempo US Responsible Fund

- Trust Management - ESG Australasian Share Fund

What does Climate Friendly mean?

Our Climate Friendly badge means that the fund has less than 0.01% invested in any company producing coal, oil or gas, or the company must be making the transition to renewable energy on a 1.5 degree pathway. Read about the criteria for the Mindful Money Badges here.

Fossil Fuel Production – Where companies are involved in the production of fossil fuels (oil, natural gas, coal, shale oil) including exploration, production (including core services), storage, transport (except by rail) and refining.

Fossil Fuel Power Generation – Where companies source their power generation from fossil fuels (oil, natural gas, coal) to generate electricity.

Read more about our methodologies for identifying companies here.

Climate Friendly Investment Fund

The following fund holds our climate friendly badge, meeting our criteria. Read more below.

TAHITO Te Tai o Rehua Fund is an indigenous ethical and sustainable fund. The Fund uses positive Environment, Social and Governance (ESG) integrated screens in selecting investments. Māori indigenous values and principles serve as the foundation to the Fund’s philosophy and investment selection process. The Fund will provide actively managed exposure to a portfolio of primarily New Zealand and Australian companies that have been selected in accordance with the TAHITO investment philosophy.

This fund has no investments in any of Mindful Money's companies of concern.

Already moved your money to an ethical KiwiSaver fund?

Please share so others can make their money a force for good too.

Join our mailing list to hear about the latest research and news, events and ways to get involved.

Learn more about how to invest for a safe climate

Your money and your carbon footprint

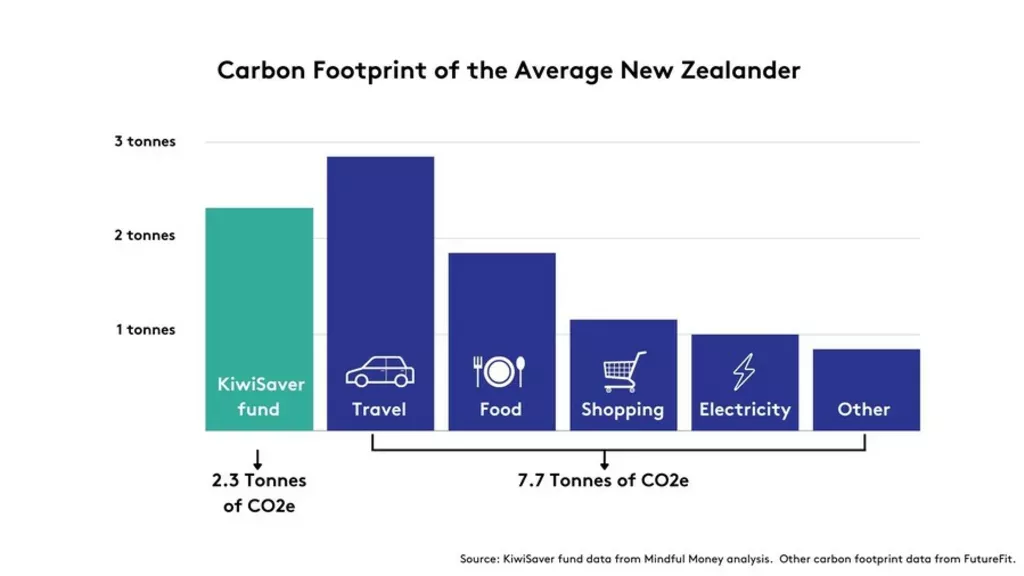

When most people consider their carbon footprint, they think about their electricity use, or travel by car, or the food they eat. These impacts are important and add up to around 7.7 tonnes of carbon dioxide equivalent for each New Zealander.

Few people think about the climate footprint of their KiwiSaver fund or their other investments. Yet they are important. Your KiwiSaver fund's impact is surprisingly large.

Your KiwiSaver invests mainly in companies, and they have very different impacts on the climate. We now have measures of the greenhouse gas emissions from most of the public companies (those listed on a share market) and so we can add up the emissions in our funds.

For example, an average KiwiSaver fund invested in global shares has a footprint of around 2.3 tonnes of CO2 equivalent. That’s larger than most other elements of an individual’s carbon footprint.

What is Active Ownership?

The investors who hold shares in companies are their owners. They have the power to elect and fire Board members, and to pass resolutions that require action from companies.

Active ownership recognises that fund managers can use their power to support, persuade, or require companies to reduce their emissions.

Fund managers can engage with companies directly or via third parties. For NZ fund managers, the direct engagement is generally with NZ companies. Few of these engagements have been made public.

When investors group together to take action, they can have a strong influence, particularly when they own a large minority or most of the shares.

For example, in response to the March 2019 terror attacks on Christchurch mosques, The NZ Super Fund and other NZ investors, supported by 105 global investors representing approximately $13.5 trillion of funds under management, began a collaborative effort to engage the world’s three largest social media companies (Facebook, Alphabet and Twitter). The aim was to strengthen controls in order to prevent the live-streaming and dissemination of objectionable content. An evaluation report was prepared showing some progress in putting controls in place to prevent social media coverage being used by terrorists in future incidents.

The use of an evaluation report to show whether change has been achieved as a result of engagement is crucial. Some funds have started reporting on their engagement with companies or their voting patterns on resolutions, but that does little to show that engagement has changed company practices. This was an important issue highlighted during Mindful Money’s inaugural ethical and impact investment awards in 2021 and in our online seminars.

Investors are also demonstrating they are willing to take more forceful engagement action if companies fail to respond. A recent example was provided when major fund managers joined a small hedge fund, Engine No. 1, to elect three new dissident directors to push for cleaner energy at Exxon Mobil, discussed in this article ‘What just happened?’. This demonstration of investor power sent shockwaves through board rooms internationally.

However, companies are good at promising change and delivering little. An assessment of the changes that have been actioned by Exxon since the shareholder action show that they have continued to double down on exploring for more fossil fuel and developing new fields, rather than transitioning to renewable energy. The real test of active ownership is not in the promises made but in the action taken.

Active engagement is undertaken by a number of KiwiSaver and investment funds.

Invest in climate action

Investing for climate action is not just about switching away from fossil fuels or other high greenhouse gas emitters. It is also about channelling funds into the companies and assets that will drive the transition to a clean economy.

Read about the retail investment opportunities available in our impact directory.

Aotearoa New Zealand Investor Coalition For Net Zero

Mindful Money has initiated a new coalition of organisations to accelerate climate action by New Zealand’s asset owners (the trusts and foundations, iwi, churches and others that own pools of funds), wealth managers (financial advisors and wealth management businesses) and fund managers (the KiwiSaver and investment providers that manage the funds).