Learn More

Ethical Returns

Does Ethical Investment Earn Good Financial Returns?

The good news is yes!

There is growing evidence that returns from well-managed ethical investments are, on average, at least as high as from conventional investing.

There are many reasons why companies that do good also do well financially. For example:

- Companies that are well-managed in terms of strong environmental performance, good social policies and good governance also do well financially. For example, companies that behave ethically avoid fines for environmental damage, they have a better reputation (which is important for their brand value and customer loyalty) and have productive employees.

- Companies with strong social, environmental and governance standards often have lower risks. There have been a string of companies that have behaved badly and suffered financially as a result - Facebook, VW, BP, Enron, Solid Energy (Pike River mine).

- Companies in unsustainable sectors typically risk market declines and stranded assets. The performance of coal companies over the past decade is an example. More than half the coal mines in the US have shut down and the biggest coal company went into bankruptcy. By contrast, clean tech and sustainability sectors are growing rapidly.

Because portfolios are collections of companies, high environment, social and governance (ESG) standards for individual companies result in high ESG standards for the overall portfolio and the potential to earn higher returns.

There is growing evidence to support this proposition. An article in business journal Forbes said it is "the most entrenched misconception" that returns from Ethical Investing are not as high as from conventional investing.

Long term studies show that, on average, responsible investing earns as much or more than conventional investing with lower risks. There is growing evidence from credible research institutes, universities and companies showing that, on average, responsible investment funds have returns that are at least as high as, or higher than, conventional funds.

- Academic research shows that Responsible Investing earns higher returns. Academics from Hamburg University analysed 2200 different comparative studies and concluded that the large majority show higher returns for Responsible Investing.

- Large meta-studies show lower risks. Morgan Stanley's Institute for Sustainable Investing examined 11,000 studies on mutual funds and found that responsible investment funds have comparable returns and lower downside risk, especially in times of volatility.

- Research studies show strong evidence of better performance. For example, a meta-analysis of 200 studies published by the Smith School at Oxford University shows a large majority of companies with good sustainability practices had lower cost of capital, better operational performance and higher share price increases compared to the mainstream.

- Higher returns are also shown for responsible investments in Australasia. Comparisons by the Responsible Investment Association of Australasia between responsible funds and mainstream funds show higher returns for responsible investment across most time periods for both the New Zealand and Australian markets.

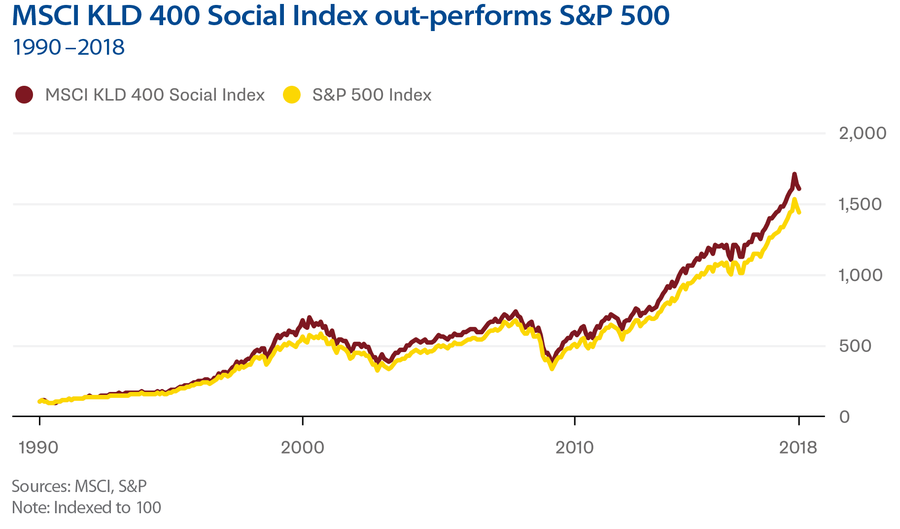

- Higher returns are shown in some long-term comparative indexes. The longest running inex with Responsible Investing criteria, the MSCI KLD 400 Index has had higher returns than the US market average in each comparative period and since its inception in 1990 (see below).

Despite the above, there are no guarantees that any specific responsible investment fund will earn high returns. There are always risks with investments, and responsible investing is no exception.

So Why Not Invest Responsibly?

The good news is that, as well as good financial returns, there are also other benefits from being responsible. You invest in ways that align with your values, you shift money away from companies that pollute the environment and exploit people, and you create societal benefits. Win win win!

Every time you invest money, you are making a vote for the kind of world you want to live in.

If you want to dive deeper into the evidence, there's more materials on this platform. Learn more about the evidence