Learn

What are our KiwiSavers invested in? Sept 2023 Data

5th Feb. 2024

There has been a significant change in KiwiSaver investments over the past 6 months. Some of the largest KiwiSaver fund providers are reducing their investments in companies that are doing harm. The result is the biggest fall in harmful investment since Mindful Money started tracking ethical investment trends five years ago.

There has been a significant change in KiwiSaver investments over the past 6 months. Some of the largest KiwiSaver fund providers are reducing their investments in companies that are doing harm. The result is the biggest fall in harmful investment since Mindful Money started tracking ethical investment trends five years ago.

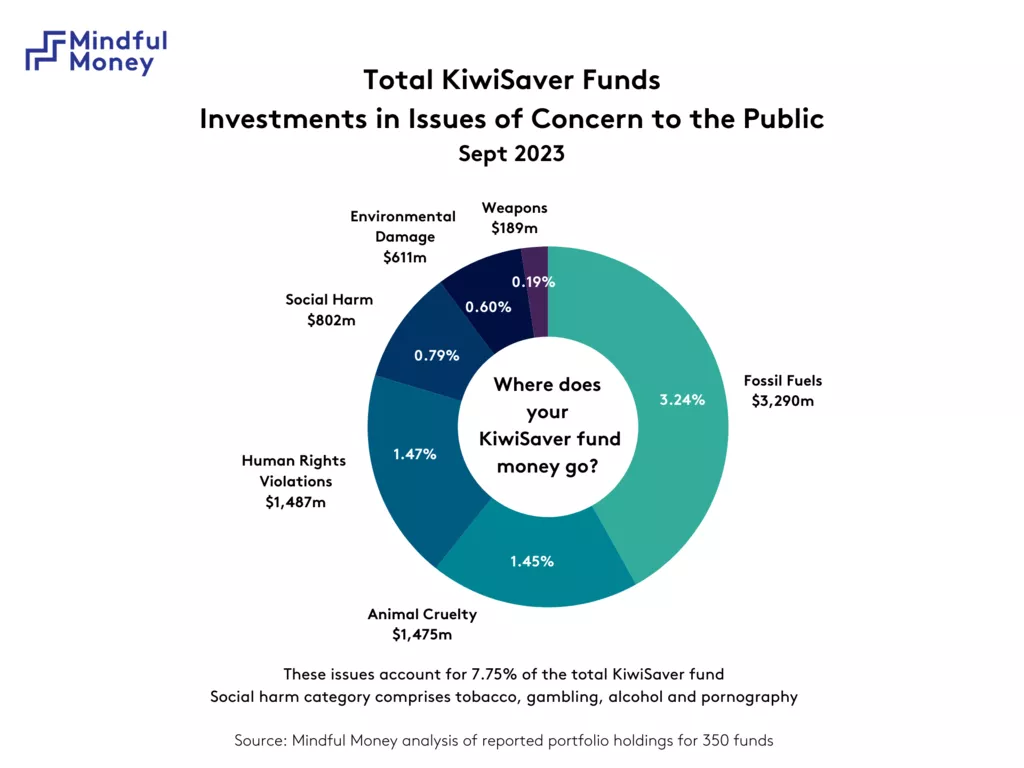

Barry Coates, CEO of Mindful Money welcomed the progress: “Analysis by Mindful Money shows that KiwiSaver providers are listening to their customers and getting out of investments in companies that their customers want to avoid. This is an important step, but there is still a long way to go - there is still $7.9 billion invested in companies investing in issues like fossil fuels, weapons, animal cruelty and human rights violations.”

Doing less harm

It is now seven years since there was a public outcry over KiwiSaver investment in tobacco and cluster bombs, and five years since Mindful Money brought transparency to KiwiSaver investments. The most ethical KiwiSaver providers have responded to their clients’ wishes and reduced their investment in the companies that most investors wanted to avoid. But progress amongst the larger funds has been slow. Until now.

The good news

This is a decisive move by Kiwisaver managers. They have significantly reduced investments in harmful investments that members of the public overwhelmingly want to avoid. In the six month period to September 2023, the amount of KiwiSaver portfolios invested in harm has plummeted:

- 72% reduction in investment in tobacco companies

- 35% reduction in weapons

- 29% reduction in gambling

- 25% reduction in companies that test their products on animals or cause animal suffering

- 24% reduction in alcohol

- 16% reduction in pornography/adult entertainment

- 7% reduction in environmental damage

These reductions are even more significant as a proportion of the total because KiwiSaver investment was 4.8% higher in September 2023 (a record $101 billion) than in March 2023.

Mindful Money CEO, Barry Coates commented: “This is a major shift in the KiwiSaver scheme. It shows that transparency makes a difference. Over 300,000 people have visited the Mindful Money website since its establishment four years ago. They have been able to see which companies they are invested in through their KiwiSaver fund. The most common reaction has been ‘I didn’t sign up for this’. Many have complained to their KiwiSaver provider or switched funds. Consumer power is changing the practices of the investment sector.”

“The change in investment patterns by KiwiSaver providers is important. This means far less funding is going from KiwiSaver investors into companies that create harm. These shifts, as part of a global movement for ethical investment, have a significant impact on the share price and cost of capital of companies causing harm. Investors have power and they can use it to make a difference.”

The not so good news

There is still $7.9 billion of KiwiSaver funds invested in the companies of highest concern to New Zealand investors. While this is falling as a proportion of total KiwiSaver funds, there is still a substantial gap between the wishes of consumers to avoid harmful investing and the choices made by KiwiSaver fund managers.

The reductions outlined above have not yet been reflected across all issues of concern. In particular, there has been a continued increase in KiwiSaver investments in fossil fuels and in companies that are cited for human rights violations (although both are less than the increase in total KiwiSaver investment).

Fossil Fuel Investment

Investment in fossil fuel companies is at the highest level ever, at $3.29 billion. Over one third (37%) of that investment is in global companies that are still expanding their exploration and production, and a smaller amount (34%) in companies (like Contact Energy) that are transitioning to renewable energy on a 1.5°C pathway.

Barry Coates commented: “This is hard to understand at a time when hundreds of thousands of Kiwis are suffering from the impacts of extreme weather related to climate change. KiwiSaver investors are still supporting the fossil fuel companies that are contributing to the flooding, wildfires, sea level rise and droughts that are causing massive suffering in our communities and in the poorest and most vulnerable communities, including our Pacific neighbours.”

“KiwiSaver providers should divest from fossil fuel companies that are not transitioning to renewable energy on a net zero pathway. Companies like Exxon Mobil and Shell have been promising to make the transition for over 30 years since the climate convention was signed in 1992. It is time to stop the greenwash. Companies that are still increasing their exploration and production are wrecking our climate.”

“These investments are also financially risky. The companies still increasing their production, and the KiwiSaver providers investing in them, are risking huge losses from a decline in production and from stranded assets - the infrastructure and reserves that will become unusable in the future. The International Energy Agency predicts fossil fuel demand will decline after 2028, a few short years away. The rate of decline is likely to be steep.”

“The impact on share prices has already started. Despite the increase in oil prices caused by Russia’s invasion of Ukraine, the value of fossil fuel companies, measured by the US Oil & Gas index is still 6.7% below the level 10 years ago. During that time the S&P500 index has risen 260.1%.”

Investment in companies violating human rights

Included in the companies under the human rights category are Israeli and global companies that have a direct involvement in developing and maintaining Israeli settlements in occupied Palestine. The New Zealand government co-sponsored the UN Security Council resolution 2334 which declared that Israeli settlements were a violation of international law. The total investment across all KiwiSaver funds is $124 million.

Barry Coates said: “A growing number of individual KiwiSaver investors have expressed concern over their funds being invested in companies supporting the illegal Israeli settlements in occupied Palestine. Analysis by Mindful Money identifies the companies and which KiwiSaver funds are making those investments.”

Mindful Money has called on KiwiSaver providers to divest from companies supporting the settlements. The conflict in Gaza broke out after the end of September 2023, the date of this portfolio analysis, so any subsequent divestment of holdings is not reflected in this analysis.

What has changed?

There has been an increase in the number of Kiwis who are finding out about what is in their KiwiSaver fund. It is quick, easy and free for members of the public to see what companies their KiwiSaver fund is invested in at https://mindfulmoney.nz/kiwisaver/checker/. The power of transparency is to expose those holdings for all to see. As a charity, Mindful Money is committed to making it easy and free for investors to see what they are invested in. They can then make their choices about where they invest.

So who are the big movers?

Until now, most of the shift towards ethical investment has come from the smaller and medium-sized funds, including Pathfinder, Medical Assurance Society (MAS), Simplicity and Always Ethical. However, over the past six months we have seen significant reductions in harmful investment by many of the largest KiwiSaver funds:

ASB: 37% reduction in issues of concern from March 2023 to September 2023

AMP: 22% reduction

ANZ: 16% reduction

In addition, the fastest growing fund, Aurora, recorded a 23% decline in issues of concern.

Most of the reductions have been a result of changes that KiwiSaver managers have put in place over recent years to reduce carbon emissions in their portfolios and increase investments in companies with higher social and environmental standards. Funds such as ASB and Aurora have also changed their external fund providers to reflect a more ethical approach.

Doing Good

KiwiSaver investors want to ensure their money isn’t invested in harm, but they would also like at least some of their money to be invested in companies that are doing good. The 2023 survey of the New Zealand public revealed that 80% of respondents are interested in investments that have a positive social and/or environmental impact.

There is a large and growing impact investment movement internationally. In New Zealand, KiwiSaver providers are interested and are starting to build positive impact into their investment portfolios. Some of the early movers have been Pathfinder, Generate KiwiSaver and Simplicity.

Mindful Money’s analysis shows that KiwiSaver providers are increasing their investments in companies that have a positive impact on society and the environment. Examples are investments in climate solutions (primarily renewable energy) and social housing (such as the Salvation Army social housing bond). Others, notably ASB, Devon and Harbour, have introduced standalone funds that include investments in positive impact companies.

Barry Coates concluded: “Alongside the reduction in harmful investment, there is an important shift in investment towards positive impact investments. Typically, the aim for these investments are to contribute towards meeting challenges of the climate transition, environmental regeneration and social well-being at a comparable rate of financial return to other investments.

While the scale of these investments is still small, they are important to customers and potentially hugely important for New Zealand’s future.”

Notes

The ‘issues of concern’ are derived from annual surveys of the NZ public. Respondents are asked which investments they want to avoid. The list of these issues has been remarkably stable over the past five years. The surveys are commissioned by Mindful Money and the Responsible Investment Association of Australasia (RIAA). The 2024 report will be launched on 9th April 2024.

A company may be cited for more than one issue of concern (such as BHP for fossil fuel production and for human rights violations).

The methodology for analysing portfolios and defining issues of concern is documented in Mindful Money’s section on methodology on the website.

The classification of fossil fuel companies into those expanding their expiration and production versus those on a 1.5°C pathway is here.

Mindful Money has undertaken a survey and related research on mainstreaming investment in positive impact companies. This includes the role of private capital investments, an issue raised by the new Minister of Commerce and Consumer Affairs earlier this week.