Learn

Seminar Series: Mindful Money, one year on

1st July 2020

Barry Coates, CEO and Founder of Mindful Money, was joined by Karen Swainson, Mindful Money's Operations Manager, to review the first year of operations, and why Mindful Money's work is so important in the work towards a sustainable future.

(there was a recording problem at the beginning so it starts after a few minutes of introduction).

Mindful Money’s CEO, Barry Coates introduced the seminar as being a celebration of Mindful Money’s first birthday – it has been one year since the launch of Mindful Money’s website.

He welcomed Karen Swainson, Operations Manager for Mindful Money. She is committed to sustainability, a trustee of Ooooby and 350 Aotearoa and a founder of Love Titirangi. She has a Masters degree in mathematics from Cambridge University.

Barry told the story of how he got involved in ethical investing and why he founded Mindful Money (which is where the YouTube video starts). He was in London on his long OE when he got involved in a campaign to support West Papuan people who were suffering from a huge mining company, Freeport Mining - they were dumping 200,000 tonnes per day of mining tailings into the local river. When the indigenous West Papuan people complained, the Indonesia military, paid for by the mining company, committed human rights abuses.

Then he did some research and found out that his pension funds were invested in Freeport Mining. He was one of the shareholders that he was campaigning against! It was his money that was financing this abuse. Like many others, he had never asked which companies his money was funding.

As a result, he helped set up the ethical investing network in the UK. He then went off to do other things, including running Oxfam New Zealand for a decade and leading the campaign to build the Fair Trade movement in NZ. There were strong parallels. Barry could not understand why ethical investing hadn’t taken off like Fair Trade.

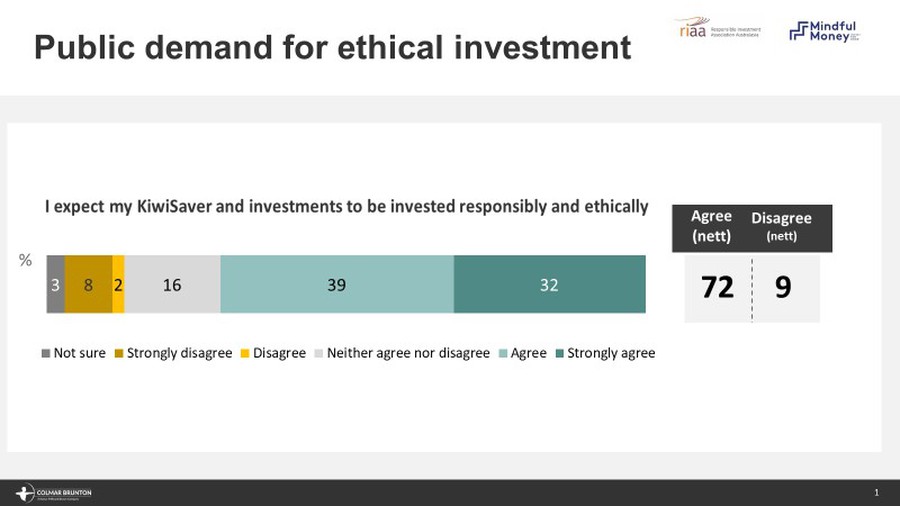

So he joined with the Responsible Investment Association of Australasia to do some research on what Kiwis think about ethical investing. He found that most Kiwis want our money to be managed ethically.

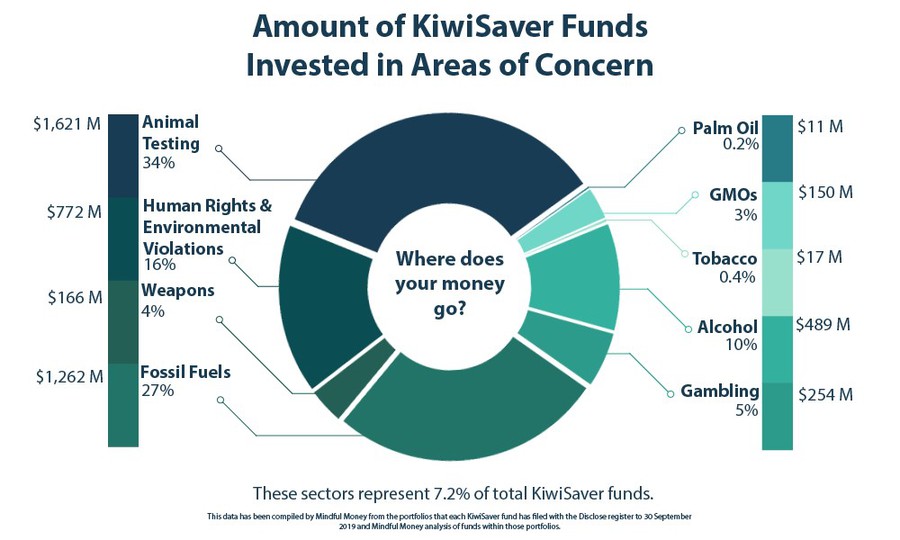

However, despite the high level of demand, few New Zealanders proactively invest ethically. The result is that billions of our money is spent on issues that the public wants to avoid.

The survey told us there were three main barriers for people to invest ethically:

1. A lack of objective information on what’s in KiwiSaver and other investment funds. People don’t know where their money is invested, or if they do try to find out, they are given a long list of company names that mean very little.

2. People don’t have the time to do the research to find out about ethical options and compare them. We have spoken to many people, even those with finance degrees, who tried to do the research and comparisons but gave up, saying it was too hard.

3. They’re not sure what’s greenwash and what’s credible. There are a lot of claims about being ethical but the public are confused about what is real and what is greenwash.

The information from the survey provided a blueprint to set up Mindful Money and help people overcome these three barriers. Mindful Money is about engaging the public and then making it easy for everyone to see the information and to find an ethical fund. Barry started to build a Mindful Money team, and that’s when he met Karen Swainson. Karen continued the story.

Going back 10 years, Karen and her husband were thinking about having kids, and wondering whether they wanted to bring children into this world with such an unpredictable future, or in fact whether the planet needed more children. They decided to have children, but committed to bringing them up as little ecowarriors and to making sure they, and all children, had a sustainable future. There’s a lot of work to do on that front, so Karen focuses on the best way to use what she is passionate about and what she is good at to make the biggest impact.

Speaking of impact, analysis by Nordea, Scandinavia’s largest financial services company, showed how ‘greening’ an individual’s financial assets, such as savings and pensions, could generate far greater improvements in a personal carbon footprint than eating less meat, using public transport, reducing water use, and flying less.

Jonathon Porritt, the British environmentalist who was on the Mindful Money seminar series a couple of weeks ago, has talked about his frustrations with how individuals interpret their personal responsibility – with modest actions like changing light bulbs, or eating meat one less time a week – but people don’t think about how they manage their finances, which is bizarre.

However much money we have, however we spend or invest it, there is always a good choice and a bad choice. Every time we spend money, we are making a vote for the kind of world we want to live in. We can ask ourselves how we shop, eat, travel, bank, earn a living, and how each of those make an impact on society and the planet.

Barry described our main strategies for Mindful Money:

1. Engaging hearts and minds to invest ethically – we want to make a powerful case to as many members of the public as possible. By investing ethically, people can feel good about where their money is invested; do good for people and the environment; and earn good returns – research now shows that companies and funds with high ethical standards earn higher returns than comparable funds. Most people know that – the most sustainable companies are the ones with the strongest brand and loyal customers, they have motivated employees and no environmental liabilities. Why not invest ethically?

2. Making it easy for people to invest ethically – our website makes it quick, easy and free to invest ethically.

3. Influencing the finance sector – we are working with the fund providers and the range of others in the finance sector to help them understand the public demand for ethical investing, and to improve their offerings. In particular, we want to help them move from just avoiding doing harm through their investments to making a positive impact through investments in companies providing renewable energy, clean water, affordable housing etc.

4. Changing the rules – and we are working to change the government’s rules and the industry practices so that finance supports rather than undermines the path towards zero carbon, the Sustainable Development Goals and improved well-being.

Karen outlined where we are on our journey after year one. She noted that Mindful Money is a small start-up charity but we’re achieving a huge amount with the little money we have. One of the ways we are able to do that is through the work of our amazing team of volunteers. For example, our research team of 17 volunteers has spent thousands of hours analysing companies and organising data to lay the foundations for our website. We’ve done the research so members of the public don’t have to.

The website makes it quick, easy and free for people to shift their KiwiSaver funds. 16,000 people have looked at their KiwiSaver funds on our website and found out what companies they’re invested in. Through the website we have shifted $9m into Mindful KiwiSaver funds in our first year and we know that far more than that has gone into Mindful funds as a result of the information we’ve made available.

We’ve had some great conferences including our launch event with Finance Minister Grant Robertson as our keynote speaker. We’ve had a big effect in the finance sector, and have been encouraged that most funds are on an ethical investment path. And we’ve also influenced some policies, like the fossil free default funds.

Barry outlined plans for the future development of Mindful Money:

1. Launch a major re-vamp of our website. This is after work to understand the experience of a lot of users, including those who are unfamiliar with finances and data. These changes will make it easier to navigate and find funds that fit users' criteria and values, but also add functionality to provide more information.

2. Add managed investment funds. Mindful Money started with the 280 KiwiSaver funds and in August we will add around 400 managed investment funds. This will be particularly helpful for those who don’t have KiwiSaver funds, like many older people.

3. Build the movement. We will continue to build a movement of people who understand they can make a positive impact through their finances. This is where we need the help of our audiences and all those who care about these issues. We want to get the word out far and wide.

To help us you can:

● Join our mailing list to hear about events like these and help us build audiences for future events.

● Invite us along to do a presentation at workplaces that have a commitment to sustainability and ethics. This helps staff realise they can have an ethical KiwiSaver, and it helps organisations extend their policies to include sustainable finance. We’ve had great feedback from the workplace events we’ve done so far.

● Spread the word - like us and share us on social media, and through your social networks.

● Switch your KiwiSaver to a Mindful fund and/or invest in a Mindful investment fund. Then let your friends, colleagues and communities know they can invest ethically too.

In Q&A, Barry and Karen provided more details about Mindful Money.

Mindful Money is unique, both in New Zealand and internationally. There are no other organisations that we are aware of providing radical transparency about where investment funds are invested.

Mindful Money’s funding comes from a small number of charitable donations, mainly from Barry as founder. This has largely been used to fund the build of the website, and subsequent improvements. Mindful Money also receives a small fee from Mindful funds when people invest via the website. This contributes a small amount to ongoing costs but will hopefully grow as we grow the movement of New Zealanders who hear about Mindful Money. Mindful Money is part of registered charity, Sustainable Initiatives Aotearoa (Charity #51919) and has a Board of Trustees.

Mindful Money is not able to provide personal financial advice. Our role is to provide objective information about ethical investing and how funds meet criteria that may be important to investors. If you have any questions about your personal circumstances, you should see a financial adviser. There is a list of advisers who specialise in ethical investing on our website.

Finally, a viewer asked what the finance sector thinks of us! Barry replied that we have appreciated the openness of finance companies to engage with these issues, and with Mindful Money as a new organisation. There is a general realisation that issues of ethics and sustainability are here to stay, and they affect the financial performance of companies and investments. Most of the fund providers are aware of ethical investment issues and are, in some way, incorporating Environment, Social and Governance (ESG) issues into their investing approaches. We are working with funds across the sector to support them in doing so and to encourage them to deepen their involvement.

With thanks to our principal sponsors - Generate KiwiSaver, Harbour Asset Management, Booster Asset Management, and Sustainalytics; contributing sponsors - AMP Capital, Harbour Asset Management, Mercer and Milford Asset Management; and supporting sponsor - Devon Funds Management.