The global financial backlash to Russia’s war in Ukraine demonstrates the power of every investor to use their money as a force for good, writes Barry Coates.

Original article found on The Spinoff.

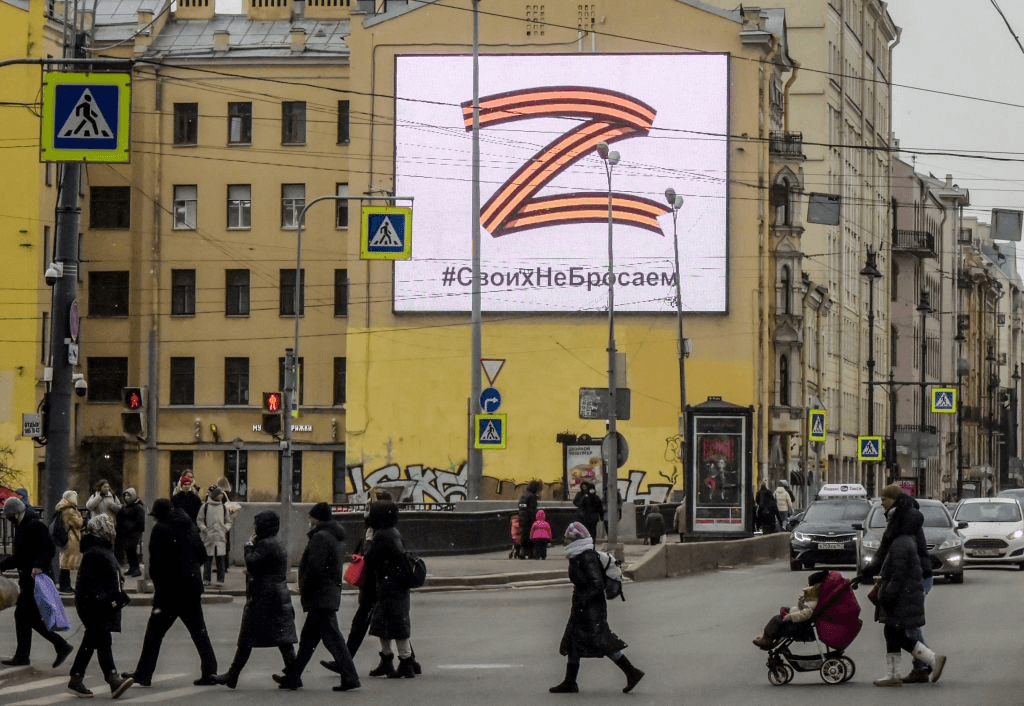

There is a new force in global politics. In the last two weeks we have seen the emergence of people power in the financial markets and corporate supply chains. Anger over the Russian invasion of Ukraine has led to a mass exodus of businesses from Russia, resulting in financial costs for the nation far beyond the formal sanctions applied by governments.

This people power reflects the global rise of an economy attuned to the interests of stakeholders – consumers, investors, employees and a huge range of NGOs and community groups. In the stakeholder economy the business of business is not just making money, but also the needs and desires of wider society as well as the company’s own long-term interests.

Government sanctions are important but now they are part of a broader response to the war. For example, while European governments have been unwilling to impose sanctions on oil, companies are responding to public opinion. Many refiners have paused imports as they struggled to find funding and tankers for cargoes of Russian oil. Participants in the supply chain feared reputational damage for their involvement in contributing supportive finance for the Russian invasion. As a result, Russian oil exports have fallen and much of it is selling at a significant discount, even before the recent announcement of the US ban on Russian oil and gas.

The economic ostracism of Russia has been growing. BP sold its 20% stake in Russian oil and gas producer Rosneft, and Shell ($3bn assets), Equinor ($1.2bn) and Exxon Mobil ($4bn assets) are selling off their investments in Russia. The ripples have spread to a wide range of automakers with investments in Russia, digital companies, and a wide range of companies trading with Russia.

The Russian economy is in crisis. The value of the rouble has plummeted, as has the share price of Russian companies that are part of the Kremlin’s inner circle. Foreign investment has virtually dried up and Russia faces a freeze on funds held in western banks, disruption to their exports and imports, and restrictions in their access to technology. Perhaps just as important are the actions to target Russian oligarchs and deny them access to their super yachts and mansions.

In New Zealand, the new government sanctions against Russia are welcome. But they come after thousands of New Zealanders have already taken action. Individual investors have pressured their KiwiSaver fund providers and investment managers to withdraw their funds from the Russian government and crony companies.

At Mindful Money, the ethical investment charity I founded. we’ve been tracking the progress of the divestment of KiwiSaver and retail investment companies from Russian government bonds and companies aligned to the Putin regime.

Some ethical investment funds did their risk analysis and divested from Russia in the early stages of the troop build up on the borders of Ukraine. However, by the end of September, when conflict was already widely predicted, there were still hundreds of funds with these investments. There was a cost to this inaction. Those that sold their shares and bonds after the invasion have lost 80-90% of their investment.

This calls into question the risk management strategy applied by these fund managers. Most of them claim analysis of Environmental Social and Governance (ESG) risk as the main tool for them to be considered “responsible” investors. However there has been widespread criticism that many fund providers have long paid only lip service to ESG management. So it seems in this conflict. The risks were predictable and financial losses preventable. Yet, many fund managers only divested well after the invasion had started.

The stakeholder economy is creating a new normal for finance. Issues of climate change, environment, social equity and morality in global politics were previously seen as irrelevant to financial markets. Now, they are crucial to financial performance in the stakeholder economy.

There are challenges ahead. Most of the world’s asset owners and fund managers claim credentials as ESG managers. They are starting to exercise their governance responsibilities and ask tough questions at company AGMs. But they have been slow to take the next step, which is to change the composition of their portfolios. As a result of this crisis, investment providers will start to pay more attention to investments that contribute to harm, including issues like climate change as well as conflict.

Another change is likely to be the choice of investing style. Many fund managers rely on low cost indexes – investing in a share of all the companies in an index like the NZX or the S&P500. But index providers have been slow to react to the external environment. They have only recently started to divest from Russian investments, losing most of the investment value. By contrast, some of the fund providers investing directly are able to be more attuned to crises and the interests of stakeholders. This crisis will remind fund providers that low cost does not necessarily mean high value, and it leads to a limited version of responsible investing.

The response to this crisis has demonstrated the close connections in our wired world. Business and politics are inseparable, and both are part of an increasingly informed and assertive civil society. We have yet to see if their combined pressure is sufficient to challenge the interests that form Putin’s power base. Time is running out for the people of Ukraine.

Barry Coates is CEO of Mindful Money. See Is Your KiwiSaver Financing Putin’s war? for a list of KiwiSaver and investment funds with Russian holdings and recent divestments.