Learn

What are our KiwiSavers funds invested in? Sept 2023 Data

18th March 2024

KiwiSaver providers make strides in reducing harmful investments, but further action is needed

In recent years, there has been a growing demand for ethical investing, with more and more Kiwis wanting their money to support companies that align with their values.

The good news is that change is happening.

Over the past six months, we at Mindful Money have witnessed the most significant shift in KiwiSaver investments since we started tracking ethical investment trends five years ago.

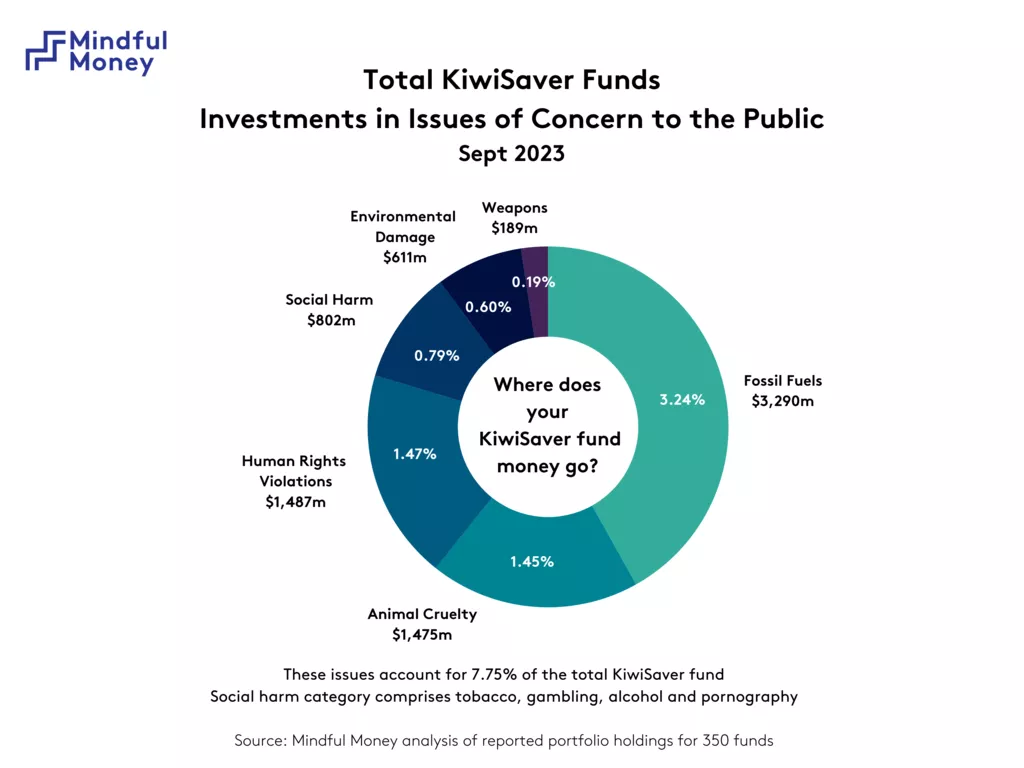

Our analysis reveals that the largest KiwiSaver fund providers are listening to their customers and reducing investments in companies causing harm. This is an important step, but there is still a long way to go - there is still $7.9 billion invested in companies involved in issues like fossil fuels, weapons, animal cruelty, and human rights violations.

The shift is substantial. In the six months leading up to September 2023, KiwiSaver portfolios saw a:

- 72% reduction in tobacco investments

- 35% reduction in weapons

- 29% reduction in gambling

- 25% reduction in companies that test on animals or cause animal suffering

- 24% reduction in alcohol

- 16% reduction in pornography/adult entertainment

- 7% reduction in environmental damage.

These reductions are even more significant considering that total KiwiSaver investment reached a record $101 billion in September 2023, a 4.8% increase from March 2023.

We attribute this change to the power of transparency. Over 300,000 people have visited our website since its establishment four years ago. They have been able to see which companies they are invested in through their KiwiSaver fund. The most common reaction has been 'I didn't sign up for this'.

Many have complained to their KiwiSaver provider or switched funds.

Consumer power is changing the practices of the investment sector.

However, there is still work to be done.

Where our KiwiSaver funds are being invested

Despite the progress, $7.9 billion of KiwiSaver funds remain invested in companies of highest concern to New Zealand investors. Investment in fossil fuel companies is at an all-time high of $3.29 billion, and there has been a continued increase in investments in companies cited for human rights violations.

This is hard to understand at a time when hundreds of thousands of Kiwis are suffering from the impacts of extreme weather related to climate change. KiwiSaver investors are still supporting the fossil fuel companies that are contributing to the flooding, wildfires, sea level rise, and droughts that are causing massive suffering in our communities and in the poorest and most vulnerable communities, including our Pacific neighbours.

Investment in War and Conflict

However, there are other conflicts supported by New Zealand investments. There are 88 KiwiSaver funds invested in companies that directly support the Myanmar military, despite their brutal assault on the courageous monks and civilians who are calling for a peaceful transition towards democracy.

There are also over 400 funds invested in companies illegally operating in the Palestinian Occupied Territories, despite a UN Security Council resolution that was co-sponsored by the New Zealand government. As responsible members of the global community, we should ensure that New Zealanders’ investments do not support or perpetuate violations of human rights and international law.\

So who are the big movers?

Until now, most of the shift towards ethical investment has come from the smaller and medium-sized funds, including Pathfinder, Medical Assurance Society (MAS), Simplicity and Always Ethical. However, over the past six months we have seen significant reductions in harmful investment by many of the largest KiwiSaver funds:

ASB: 37% reduction in issues of concern from March 2023 to September 2023

AMP: 22% reduction

ANZ: 16% reduction

In addition, the fastest growing fund, Aurora, recorded a 23% decline in issues of concern.

Most of the reductions have been a result of changes that KiwiSaver managers have put in place over recent years to reduce carbon emissions in their portfolios and increase investments in companies with higher social and environmental standards. Funds such as ASB and Aurora have also changed their external fund providers to reflect a more ethical approach.

Doing Good

KiwiSaver investors want to ensure their money isn’t invested in harm, but they would also like at least some of their money to be invested in companies that are doing good. The 2023 survey of the New Zealand public revealed that 80% of respondents are interested in investments that have a positive social and/or environmental impact.

There is a large and growing impact investment movement internationally. In New Zealand, KiwiSaver providers are interested and are starting to build positive impact into their investment portfolios. Some of the early movers have been Simplicity, Pathfinder and Generate KiwiSaver.

Alongside the reduction in harmful investment, there is an important shift in investment towards positive impact investments. While the scale of these investments is still small, they are important to customers and potentially hugely important for New Zealand's future.

What you can do:

Spread the word. Our voices have more impact than we know - talk to your friends, family, co-workers. Everyone deserves to know what their money is getting up to when they are not looking.

Workplace or community seminars. Let us know if you have a group of people who would like to hear more about investing ethically, and our team can come and host an even, either via Zoom or in person. Get in touch with olive@mindfulmoney.nz.

Tell your provider what you want. The drastic change mentioned above shows that fund managers are listening to what New Zealanders want. We encourage you to send an email or make a phone call to your bank or fund provider and tell them what you want (and don't want) them to invest in.

Align your money with your values. Want to make the move to ensure your money is not supporting the industries that don't align with your values? You can use our Fund Finder; just input your values, and it will suggest the best Mindful Ethical KiwiSaver or Investment fund that suits.