Learn

From crisis to opportunity

7th Feb. 2020

The few days in January when the skies of New Zealand were reddened by smoke from bush fires across the Tasman set the stage for our new decade. It was one of those moments that gave an insight into a future of climate chaos. The reality never quite sinks in until you experience it directly.

The few days in January when the skies of New Zealand were reddened by smoke from bush fires across the Tasman set the stage for our new decade. It was one of those moments that gave an insight into a future of climate chaos. The reality never quite sinks in until you experience it directly.

I was at the signing of the first climate change convention in 1992. Over the 28 years since then emissions have gone up and we have used up all the time for adjustment - as well as all the excuses. This must be the year of action on climate. As the well-used cartoon says, we’ve got lots to gain.

The new decade has also started with renewed attention on the flow of money that funds the production of fossil fuels, as well as other unethical business. The bush fires have kicked up ethical investing across the Tasman; there are warnings that climate risks threaten stability of the financial system; and there are signs that exhortations for change by the CEO of BlackRock Larry Fink will be accompanied by embedding ESG in BlackRock’s portfolio construction practices. Ethical investing is on the rise.

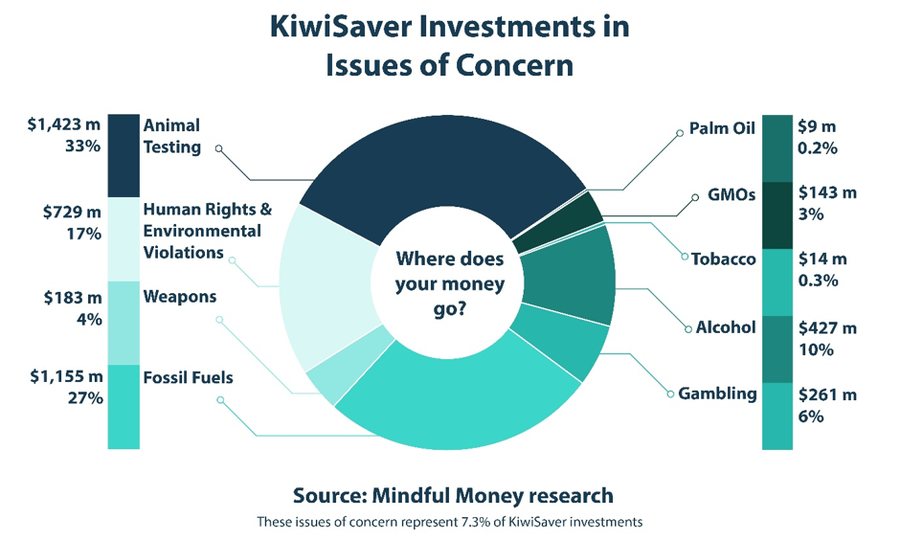

But there are barriers. Otherwise you would expect everyone who went out on a climate strike march to have got rid of fossil fuels from their KiwiSaver fund. And all the people who care about public health to have removed tobacco, alcohol, gambling and weapons. And those who care about animals to be avoiding companies that test their products on animals. We know from the companies that KiwiSaver funds invest in that this hasn’t happened. But it should.

The two main barriers that were cited in our annual survey this year were a lack of objective information and not enough time to do the research to compare between the options. This is why we set up Mindful Money. It’s free for users, and we make it simple and easy. It makes objective KiwiSaver information easy to access, and funds quick to compare.

Mindful Money launched its platform six months ago, initially focusing on KiwiSaver. It uniquely allows KiwiSaver investors to know where their funds are invested, for both direct and indirect investments, in categories that are of concern to the New Zealand public. A Fund Finder helps users find a more Mindful fund that most closely fits their criteria. By the end of 2019, our platform had been used to switch over $5 million of funds to a more Mindful fund, and we have a target of $50 million by end 2020.

The influence of Mindful Money has been far greater. We established as a charity to allow us to focus on our mission of shifting finance to more positive social and environmental impact. Anecdotally, our impact on KiwiSaver funds has already been significant. The transparency that has come from showing the public what is in their portfolios has encouraged fund managers to deepen their ESG practices.

This influence has been enhanced by Mindful Money analysis, which shows that $4.3 billion of KiwiSaver investments are in sectors that the vast majority of New Zealanders want to avoid.

More detailed analysis shows that over $500 million of the money in fossil fuels is invested in the top 20 fossil fuel entities that have been responsible for 35% of greenhouse gas emissions in recent times and $100 million of the weapons investments goes to companies that make nuclear weapons.

The Commission for Financial Capability has recognised the important role of Mindful Money in their report to government for the Retirement Review. They have recommended government support for Mindful Money in providing transparency on ethical practices and engaging the public. This is welcome recognition and we look forward to working with the CFFC and other government agencies to strengthen public outreach and building capability around investing ethically.

The regulatory context for finance is crucial and Mindful Money was pleased to provide a forum for policy discussion on sustainable finance with the Minister of Finance and representatives of regulators, asset managers and fund providers at our launch event last year. We will hold a follow up event in mid year. We will also continue active participation in the Sustainable Finance Forum as it develops recommendations for changes to the financial system.

Over the next few months, we will also add non-KiwiSaver managed funds onto the website in a similar format to KiwiSaver funds. And we plan to launch a series of briefings during the year on different aspects of ethical investment in New Zealand.

2020 is shaping up as an important year and the start of a crucial decade. The Chinese character for crisis (wēijī) also means opportunity. This is our year to build a movement that can transform finance towards sustainability.

We want to get the message out to all New Zealanders that they have the opportunity to use their money for good. Ethical options are available. They enable you to feel good about your money, do good in the world and earn good returns. Spread the word.

Barry Coates

Founder and CEO of Mindful Money

www.mindfulmoney.nz