Learn

Ethical Investment 101: A Guide to Investing Based on Your Values

20th April 2023

Curious about ethical investing and unsure where to start?

Curious about ethical investing and unsure where to start?

We've teamed up with the lovely Ayla Barfoot from Sustainable Business Network to tackle all those frequently asked questions you have about ethical investing. This friendly FAQ is your perfect introduction to the world of ethical investing, offering essential insights, especially for those who are new to KiwiSaver or investing in general.

Got extra questions?

No worries! Feel free to send us a message at info@mindfulmoney.nz, and we'll happily get back to you and expand on this guide. 🌿

Questions Covered:

· First up, what is KiwiSaver and how does it work?

· When you join KiwiSaver, how do you choose which fund your money goes into?

· If I'm considering changing funds, how do I find out which KiwiSaver fund is best for me?

· Is now a good time to switch, or will I be locking in my losses?

· What is an ethical investment?

· How do I determine if a fund is ethical?

· What is the impact of KiwiSaver on the world?

· So, what are the key factors to consider when you are choosing an ethical investment?

· Does my KiwiSaver have an impact on the climate?

· Does Greenwashing affect the KiwiSaver and investment industry? And what do I look out for to avoid it

· How do I balance my ethical concerns with my financial goals, and what are the fees associated with ethical investments compared to traditional investments?

· Why would someone not invest ethically, and why is this still happening?

· Where can people go to find more information or get in touch?

First up, what is KiwiSaver and how does it work?

KiwiSaver is a voluntary, long-term savings scheme set up by the New Zealand government to help citizens save for their retirement. It's designed to encourage people to develop a habit of saving while also providing an opportunity for first-time homebuyers to save for a deposit.

KiwiSaver works by pooling contributions from you, your employer, and the government. You can choose to contribute 3%, 4%, 6%, 8%, or 10% of your before-tax pay directly to your KiwiSaver account. Your employer is generally required to contribute an additional 3% of your salary, and the government provides an annual member tax credit of up to $521 if you contribute at least $1,043 by mid-June each year.

As of the end of last year, approximately 3.2 million New Zealanders had over 64 billion dollars invested in KiwiSaver. This amount has since grown to 90 billion dollars, demonstrating the popularity and growth of the scheme.

KiwiSaver funds are invested in a variety of companies. Your chosen KiwiSaver provider pools your money together with other investors' money, creating a diversified investment portfolio. This diversification helps to spread risk and potentially generate better returns over the long term.

When you join KiwiSaver, how do you choose which fund your money goes into?

There are a couple of ways to choose a fund, and it's an important decision. Many people start work without much information about their options and often end up in a KiwiSaver fund simply because someone mentioned it or their employer recommended it.

You should take the time to research which fund is best for you. You can choose a fund and then switch later if needed, as it's not a lifelong commitment. If you don't proactively choose a fund, you may end up in one nominated by your employer or in a default fund, where the government places you into one of six preselected funds. It's much better to choose proactively so you can find a KiwiSaver fund that suits your needs.

If I'm considering changing funds, how do I find out which KiwiSaver fund is best for me?

Most people choose a fund to earn a financial return. On our website you can view past returns and compare funds based on their financial performance. While past returns are important, they aren't necessarily a good guide for future performance. It's still useful to understand which funds have performed well and which haven't.

You might also consider selecting a fund with lower fees, but you should think about net returns as well. Some funds have higher fees but use them to generate higher returns. Most importantly, consider the risks associated with each fund. The level of risk you're willing to take should depend on factors such as when you'll need the money and your personal risk tolerance.

If you're about to put down a deposit on a house, you may want to be more cautious and invest in a conservative fund. On the other hand, if your money will be invested for a long time, such as 10-30 years until you retire, you may be more willing to take on higher risk for potentially higher returns.

You can switch funds over time, and this is generally free to do.

Lastly, consider the ethical and sustainability consequences of your investment decisions, as they can have an impact on people, the planet, and the climate.

I've heard a lot in the media about changes in the economic system potentially heading for a recession, and the term "locking in my losses." Is now a good time to switch, or will I be locking in my losses?

It's a good question. The term "locking in your losses" comes from when the share market goes down, and you're in a risky fund like a growth fund, which often leads to temporary losses. If you then decide to switch to a much safer fund or term deposit, you risk locking in those losses instead of benefiting from the bounce-back that typically occurs in the share market.

Markets go up and down, but over a long period of time, a growth fund generally increases by about 7-9%, a balanced fund a bit less, and a conservative fund even less. Selling out when the market is down can lead to locking in your losses before the fund has a chance to bounce back and recover those losses through future gains. It's essential to be patient with your investments.

The key point is that you can switch within the same risk category. If you're in a growth fund and your money goes down, you can still switch as long as you switch to another growth fund. That way, you maintain the same exposure to similar risky companies, and you're not locking in your losses. This is important for people who want to invest ethically but are worried about locking in their losses. By investing in the same risk category, you avoid that issue.

Now we're going to delve deeper into the idea of ethical investments.

What is an ethical investment?

The terminology around this concept is not very clear. Some people refer to it as ethical investment, while others use terms like responsible investment or sustainable investment. Essentially, it's the same concept. You're trying to invest in ways that avoid companies that destroy the planet, harm their employees or local communities, or violate human rights. You're trying to avoid the bad stuff and invest in companies that raise their standards and are more socially and environmentally sound.

Ethical investment can be imprecise because definitions often shift depending on who's using the term, and the government hasn't set strong standards on what is meant by ethical investment. However, most people understand the concept well enough to determine their idea of ethical investment based on their values.

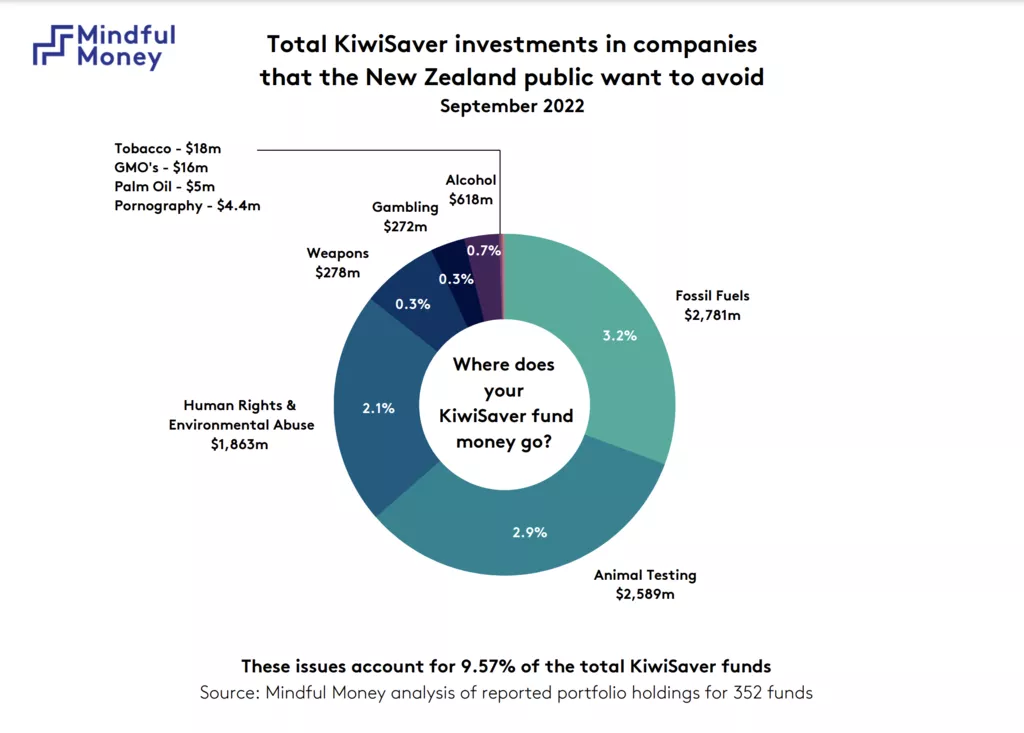

Everyone's values differ, but there is some commonality among New Zealanders regarding ethical investment, such as avoiding companies that violate human rights, are cruel to animals, invest in fossil fuels, or invest in weapons.

Ethical investing has been around for a long time, with historical examples like the public movement to divest from South Africa during apartheid or the Christian faith movement against companies engaged in slavery. Recently, ethical investment has become more mainstream as people recognize the importance of social and environmental issues, particularly climate change. This has led to increased demand for ethical investment options, but regulations haven't caught up yet. In some overseas countries, like the EU, there are more specific standards to define ethical investment, but New Zealand hasn't implemented such standards yet. It's one of the things being called for from the government.

How do I determine if a fund is ethical?

A great way to see if your money is aligned with your ethics is to use the Mindful Money checker. We conduct research on various funds to make it easy for you to check where your money is being invested.

Once you've selected your fund, the site will show you the percentages of your investment allocated to different categories of concern, like alcohol, animal cruelty, fossil fuels, gambling, human rights, environmental violations, and weapons. By clicking on the fund details, you can see the names of the companies and the categories they belong to based on the harm they cause.

These categories are based on the concerns of New Zealanders, as determined through annual surveys.

What is the impact of KiwiSaver on the world?

While an individual may have only a small amount invested, collectively, KiwiSaver accounts hold around NZD 89 billion. This amount can have a significant impact on industries and sectors, with billions invested in areas like fossil fuels, animal testing, human rights abuses, and weapons production. By shifting your investments to align with your values, you can contribute to a larger collective impact on the world.

Like many sustainability actions, individual contributions may seem small, but it's the collective action of many people making changes that can make a significant difference.

So, what are the key factors to consider when you are choosing an ethical investment?

Mindful Money's Fund Finder tool helps you choose a KiwiSaver fund that aligns with your values, investment preferences, and risk profile.

Step 1: Determine if your current fund aligns with your values visit the Mindful Money website and check if your existing KiwiSaver fund aligns with your personal values. If it doesn't, consider using the Fund Finder tool to explore alternative options.

Step 2: Answer three basic questions on the Fund Finder tool

- Question 1: Identify issues you want to avoid select issues that you personally wish to avoid, such as human rights abuses, animal cruelty, weapons, fossil fuels, or other concerns.

- Question 2: Choose your preferred investment approach rank the importance of four different aspects of investment:

- Funds that exclude specific industries

- Funds that engage with companies to improve standards

- Funds with lower fees

- Funds with higher past returns

- Question 3: Assess your risk profile consider factors like your investment time horizon and risk tolerance. For example, if you have a long-term investment horizon, you might opt for a growth fund.

Step 3: Review suggested mindful funds based on your answers, the tool will suggest mindful funds that meet your criteria.

Step 4: Research fund options examine the details of each suggested fund, including exclusions, risk profile, fees, and past performance.

Step 5: Once you've selected a fund, you'll be directed to a fund referral page. Enter your name and email to access the application page for the chosen fund. You'll need to provide your date of birth, PIR rate, and a valid passport or driver's license for verification.

Switching KiwiSaver funds might seem intimidating, but the Mindful Money Fund Finder tool simplifies the process, allowing you to invest based on your values. In just 15 minutes, you can find a fund that aligns with your preferences and make a well-informed investment decision.

Does my KiwiSaver have an impact on the climate?

However, the companies you invest in through your KiwiSaver or other investment accounts can either positively impact the climate or contribute to its destruction.

As an investor, it's essential to recognise that your investments can either be part of the climate problem or part of the solution. For instance, investing in fossil fuel companies exacerbates climate change, especially if those companies continue expanding production. On the other hand, you can support companies working on climate solutions, such as those with lower emissions, renewable energy, or technologies that reduce emissions. In the future, you may have the opportunity to invest in companies that contribute to climate resilience, helping society adapt and respond to climate impacts.

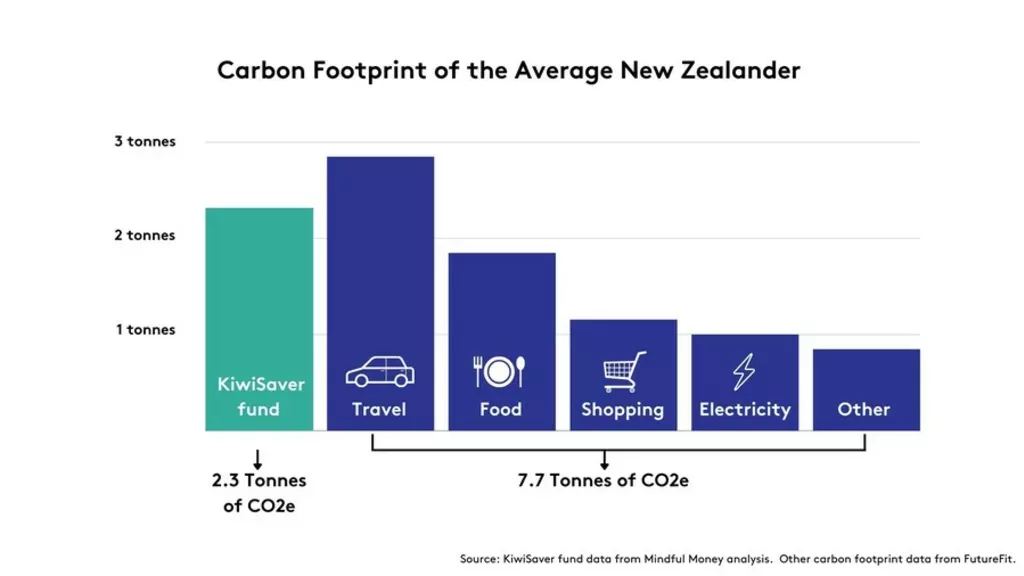

The average person's climate footprint is around seven tons of CO2 emissions per year, accounting for activities like driving, flying, and using electricity. However, this figure doesn't include the emissions associated with your investments. For the average KiwiSaver, that's an additional two and a half tons, which is significant compared to your total climate footprint.

To reduce your impact, pay attention to your climate footprint and consider which funds have a better impact on the environment. As the saying goes, every dollar you spend is a vote for the world you want to live in, so every dollar you invest can be a vote for the world you want as well.

Does Greenwashing affect the KiwiSaver and investment industry? And what do I look out for to avoid it?

Yes, greenwashing does affect the KiwiSaver and investment industry. You may see advertisements for funds claiming to be sustainable, ethical, and responsible. However, it's important to look beyond these industry claims. While it would be great for the government to crack down on overinflated and exaggerated claims, investors can take some steps themselves.

One of the most important things you can do is find out what's in your portfolio. If a fund claims to be sustainable but invests in companies that produce fossil fuels and are expanding their production, that doesn't sound right. Additionally, you can look for certification from organisations like the Responsible Investment Association of Australasia, which certifies ethical funds. You can also check which funds are deemed "Mindful funds" on the Mindful Money website, as these have met minimum standards for ethical operations according to Mindful Money's criteria.

How do I balance my ethical concerns with my financial goals, and what are the fees associated with ethical investments compared to traditional investments?

Interestingly, over a 10-year period or longer, ethical investments have performed really well in terms of financial returns. Even when taking into account that they might have slightly higher fees due to research and company engagement, ethical investments often invest in sustainable companies with good brands, customer loyalty, and motivated employees. These factors contribute to good financial returns for sustainable companies.

If you look at the evidence, ethical funds are just as likely, if not more likely, to have higher returns than traditional investments. So, unlike buying organic eggs, which can be more expensive, ethical investments often allow you to "have your cake and eat it too." You can invest ethically and still earn a good return, often higher than traditional investments. In many ways, investing ethically is a good financial decision as well as a good decision for the world. As the head of the largest investment firm in the world once said, the question used to be, "Why invest ethically?" But with the financial returns from ethical investments, the question now is, "Why wouldn't you invest ethically?"

Why would someone not invest ethically, and why is this still happening?

One reason people might not invest ethically is due to traditional finance industry practices. There's a theory that spreading your money across many companies diversifies risk, and while it's a valid approach, it doesn't necessarily take ethical factors into account. For example, if you invested in fossil fuels over a 10-year period, you would have lost money year on year, whereas if you invested in a market average excluding those fossil fuel companies, you would have made an average of 10% per year.

Investing ethically is both a good financial and ethical decision. It allows you to feel good, do good, and earn good returns.

There are several approaches to ethical investing, ranging from simply avoiding harm to actively engaging in impact investing. Avoiding harm means not investing in companies involved in weapons, fossil fuels, and human rights violations. Engaging with companies can involve investing in those in transition and pushing them to improve their social and environmental practices. This requires actual engagement, not just occasional communication.

Better standards involve investing in companies with high standards, such as those with strong supply chains and labor rights practices. Lastly, impact investing focuses on companies that do good in the world, like investing in social housing or renewable energy. This creates positive benefits, and the challenge in New Zealand is the limited choice of funds available for retail investors. Organizations like Mindful Money are working to encourage more funds to establish, providing more choices for ethical investing.

Sustainability has been discussed for years, but now the focus should be on regeneration—repairing the harm we've already created. This concept aligns with the different levels of ethical investing, moving from just avoiding harm to actively making a positive impact on the world.

Where can people go to find more information or get in touch?

A great place to start is our website (www.mindfulmoney.nz), which offers resources and information on ethical investing, such as:

- KiwiSaver and Investment fund checker

- KiwiSaver and Investment fund finder

- Further guides on how to invest ethically

- Seminar Series, where we explore in depth how money can be used to shape a better world

Another source is the Responsible Investment Association of Australasia (RIAA), especially if you're concerned about investment risks.

The government website Sorted, which also provides explanations of investment risks and how to choose a fund.

For impact investing, the Mindful Money website features a directory, and the Impact Investment Network is another resource to consider.

Don't be intimidated by complicated language or terminology—empower yourself by learning more about ethical investing.

If you have a larger amount to invest or need assistance with complex investments, consider consulting a financial advisor who specializes in ethical investing. The Mindful Money website lists certified financial advisors in this field.