Learn

Mindful Money funds outperform the average

9th April 2020

Ethical investing shows better performance during COVID-19. Funds on the Mindful Money platform have outperformed the average.

International and New Zealand data show that ethical funds have been resilient in the current crisis. Analysis of returns for the first quarter of 2020 show that Mindful Ethical KiwiSaver funds on the Mindful Money platform have significantly outperformed the average in the COVID-19 crisis.

Mindful Money’s founder and CEO, Barry Coates commented: “Investors are always looking for an X-factor, especially now that they are losing money from their hard-earned savings. These results show that ethical funds have been resilient during the COVID-19 crisis so far. The companies that manage their environmental, social and governance risks have had lower financial losses, and even some gains, in the financial downturn.”

“KiwiSaver investors need to ensure they are making the right ethical choices, as well as being in the right risk category. This analysis of quarterly results shows that being ethical doesn’t mean a financial cost – in fact, it shows that investors can have both good financial returns and do good for the environment, the climate and people.”

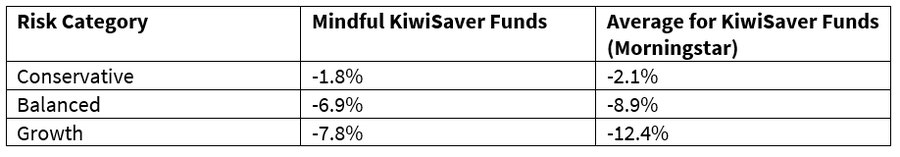

The Mindful Ethical funds on Mindful Money’s platform have outperformed the Morningstar average for each of the risk categories over the January-March 2020 Quarter. As would be expected, the outperformance is greater for the higher risk categories:

Within these results are some strong returns for specific funds. Some highlights are:

CareSaver: Outperformed the average by 4.9% across the three main risk categories.

John Berry, CEO: “At CareSaver we're an active and ethical fund manager. This is a huge advantage for our investors, particularly in times of market turmoil. Being active means we can manage our positions such as cash holdings, industries we don't want to invest in right now (for example hotels and airlines) and currency exposures. As an ethical investor, having no coal producers, oil companies or casinos has really helped returns. Also, as an ethical investor, we have focused on selecting quality companies - which is not just a strong balance sheet but importantly how companies manage environmental, social and governance risks.”

Booster – Outperformed Balanced Fund average by 2.9% and Growth Fund average by 2.7%.

David Beattie CIO: “Even before the markets reacted to the current COVID-19 crisis, our Responsible Investment portfolios had been outperforming standard portfolios, mainly due to the broad fossil fuels exclusion we implemented around four years ago. During this latest quarter, we have seen further significant falls in the price of oil and the share prices of companies involved directly in fossil fuel industries. Our active management strategies have also come into their own, as we expected during a market downturn, and our unlisted investments in the NZ horticulture space are significant strategic risk and return diversifiers.”

Simplicity – Outperformed the average in each of the three main risk categories.

Andrew Lance CIO: “Although negative returns are never good news, we are relieved the negative returns weren’t any larger. Our Vanguard managed ethically conscious funds were a significant factor in limiting our losses. Our international share fund outperformed an unscreened index by over 2.5% and our international bond fund was 0.3% ahead of an unscreened version. We also benefited from not holding Sky City due to our screen that removes gambling stocks.

Amanah: Growth fund return +5.4% vs average of -12.4%.

Brian Henry, Director: “The results are from pro-active management within the strict parameters of our Ethical Mandate which not only prohibits specific activities on ethical grounds but also requires the application of strict financial ratios to all of our investments. These financial ratios ensure all investments have very strong balance sheets that are capable of sustaining market shocks like the world is currently facing.”

Barry Coates: “These results show that investing in companies that are well-managed in terms of environment, social and governance issues also yields good financial returns. Most New Zealanders already know that companies with strong sustainability practices also have loyal customers, motivated staff and few environmental liabilities. We shouldn’t be surprised that these characteristics make them resilient in a downturn.”

“Mindful Money makes ethical investing simple. Anyone with a KiwiSaver account can see how ethical their KiwiSaver fund is by visiting Mindful Money’s website. They can see whether they are investing in companies that produce fossil fuels, make weapons, violate human rights or test products on animals. They can then compare across funds and use the fund finder to look at their options and switch to funds that match their investing criteria. Mindful Money’s website www.mindfulmoney.nz is free, quick and easy to use.”

Mindful Money will hold a Facebook Live event at 4pm on Thursday 9th April, enabling the public to learn more about investing ethically. This will be followed by a weekly series of live talks on zoom and Facebook, including interviews with financial experts, ethical fund providers including CareSaver, Booster and Simplicity, and international leaders in finance and sustainability.

Barry Coates concluded: “Now is the right time for investors to look at the performance of their KiwiSaver fund, financially and in terms of its impact on climate change, the environment and social issues. By investing ethically, they can feel good about their investment, do good in the world and earn good returns.”

See RNZ article here